This week at REN21, we’re putting the spotlight on the role of financing and investment in the energy transition.

We spoke with Ahmed Al Qabany, Manager of the Climate Change Division, and Hussein Mogaibel, Global Lead Energy Specialist, of the Islamic Development Bank (IsDB), to discuss what they are doing to help the energy transition.

The switch to renewables, although necessary, requires capital: Building new infrastructure, running and maintaining equipment, and training a new workforce. Financing is particularly problematic in developing economies, where the be capacity for accumulating or attracting large investments isn’t in place. Here, the financial solutions created must be as innovative as the technology deployed.

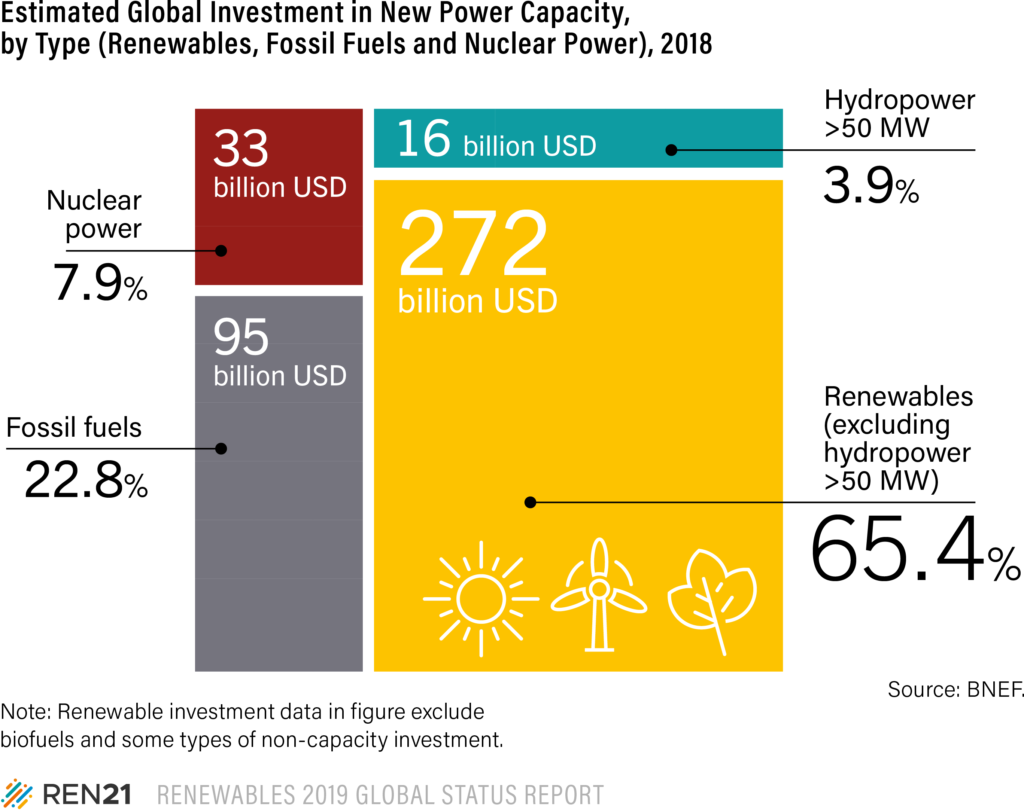

In 2018, global investment in renewables totaled USD $289 billion

Investing in renewables is big news. According to our Renewables 2019 Global Status Report (GSR), global investment in renewables totaled USD $289 billion in 2018. Furthermore, investments in developing and emerging economies overtook those of developed countries for the fourth year running.

So, what role do large funding institutions, like multilateral development banks, play in the switch to renewables?

As finance leaders of the Islamic world, Mogaibel explained the importance of renewables to the IsDB. “The sector of renewable energy and transition financing has become a main strategic area, in terms of increasing our involvement in renewable energy and broadening our portfolio.”

“The IsDB and other multilateral development banks act in the upstream dialogue of the energy transition. There is a central role we can play in helping countries move towards renewable energies and the goals of the Paris Agreement”, explains Al Qabany.

Finance mechanisms need to be innovative to encourage the private sector

As well as their usual role in sovereign financing, the IsDB builds knowledge-sharing between communities and nations. “We can help by providing expertise on innovative finance mechanisms” says Al Qabany, “These will allow commercialisation of renewable energy projects, making them economically feasible for developing countries.”

Data from GSR 2019 highlights the important role played by private actors in the renewables sector, both through procurement and investment. In locales where funds are sparse, Public-Private Partnerships (PPPs) are a way forward.

In addition to attracting financing and investment, Al Qabany underlined the need to assist countries to access available funds. “There are several funds available at the global level but accessing them can often be difficult. At the IsDB we help member countries by giving guidance and building capacity so they become eligible for financing. Many countries now have targets in terms of energy mix and renewables, so this is a good opportunity for banks to be aligned with local goals and help make them more ambitious.”

The greatest challenge? Projects must be bankable

The greatest challenge for the energy transition in terms of financing and investment is that projects need to make financial sense: “Projects must be bankable, especially when working with the private sector. This is where the Multilateral development banks can play a role: Investing capital themselves, attracting private sector capital, and improving the investment environment”, Mogaibel tells us.

And where globally does the Bank see the greatest opportunity for moving forward in financing renewables? “There is growing opportunity in almost all or our regions of operation. Namely, MENA, Sub-Saharan Africa, Central Asia and Southeast Asia. We especially see great opportunity with regards to energy access in Sub-Saharan Africa” explains Al Qabany: “We are working to encourage PPPs and upgrade renewable energy infrastructure, especially off-grid. The IsDB helps share knowledge from countries, who are experienced in attracting private sector investment.”

“One small example is a south-south cooperation between Morocco and Sub-Saharan countries, based on reverse linkage modalities”. Through this model, experts from Morocco provided technical experience in the rural electrification to some Sub-Saharan countries. For example, the design and sizing of hybrid power generation facilities, building distribution networks, and planning effective and coordinated operating procedures. Thanks to these dialogues, solar rural electrification projects have been launched in Sub-Saharan countries, including the Gambia, Mali and Chad.

Read more about the IsDB’s projects in their Projects Database.

Background

REN21 is the only global renewable energy community of actors from science, governments, NGOs and industry. We provide up-to-date and peer-reviewed facts, figures and analysis of global developments in technology, policies and markets. Our goal: enable decision-makers to make the transition to renewable energy happen – now.